Whatever the scenario for the SaaS vendor – during a Free Trial, as a free user of a Freemium, for Demo requests or Enterprise Pricing Inquiries, or after a prospect becomes a paying customer, I get asked all the time what the best email follow-up sequence is. While addressing the ideal follow-up email sequence may […]

SaaS Pricing Model: Mo’ Money, Mo’ Problems

This is a post about SaaS pricing models… but it starts with a story about human behavior. We all know that money doesn’t buy happiness – it buys freedom, and it’s with that freedom that you can choose to do things that make you happy. Money is just the means. But quite often, as people […]

The Customer Acquisition Cost (CAC) Myth and Misguided Optimization

For any company – especially those in the expansion stages – Customer Acquisition Cost (CAC) is a key metric to focus on. And for most companies and their CFOs and COOs, it’s all about making that number as low as possible. But in my experience, it’s not just about lowering CAC so you pay less to […]

5 Rules for Successful Growth Hacking

Growth Hacking is all the rage right now. In-fact, anyone even slightly involved with marketing or product development in tech companies now calls themselves a Growth Hacker. Now, once everyone identifies as a Growth Hacker the term will be meaningless… but what goes into Growth Hacking (or whatever it’s called in the future) will persist […]

SaaS Pricing: Multi Currency Support

I was asked a question recently about creating SaaS pricing models that include multi currency support. I’ve attempted to answer the question in a meaningful way, but I am the first to acknowledge that there is a lot more to it than just what I talked about in this post. But it’s a great jumping […]

How to Create an Affiliate Program for your SaaS

The CEO of a vertical-specific SaaS vendor with a relatively high priced offering emailed me the other day with a question about creating an Affiliate Marketing program to accelerate growth. I gave him a fairly detailed answer and I thought I’d elaborate on that answer even more and share it with you… enjoy. “Hey Lincoln, […]

SaaS Marketing: 21 Growth Hacks to Test Today

Below are 21 SaaS marketing growth hacks you could test right now. Of course, these are tactics and while everyone loves tactics, if they don’t make sense within your very well thought-out SaaS marketing strategy, you should probably not implement them, right? In fact, you should also probably make sure you have a well-thought-out SaaS […]

SaaS Freemium Customer Acquisition Costs

I got an email the other day asking about Freemium Customer Acquisition Costs (CAC) and whether or not to include the cost of supporting and marketing to free users in the cost of acquiring paying customers. Here’s my quick answer and some other resources for you to check out.

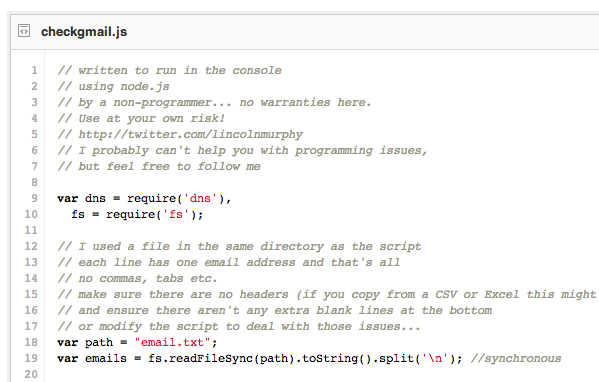

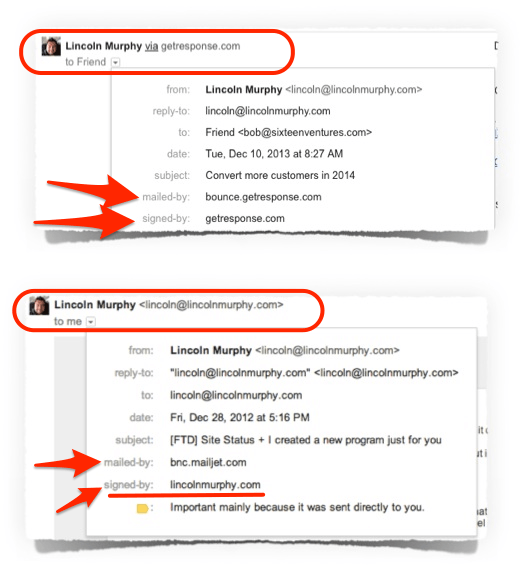

No More Email from Your SaaS App? Introducing GMail Tabbed Inbox and Categories

Attention SaaS Providers: If you use email in any way to communicate with your users, customers, and prospects, you should care about GMail’s recent additions: Tabbed Inbox and Categories. As a SaaS provider, you leverage email for marketing with things like your newsletters and your Free Trial follow-up sequence. But you also send transactional messages […]

SaaS Free Trial: Require a Credit Card to begin?

So, should you require a Credit Card to get started in your SaaS Free Trial? TL:DR – By asking for a Credit Card up front, you will get fewer prospects into your Free Trial with no guarantee of converting more paying customers. Now, if you’d like to know why that is, read on…

SaaS Customer Success: Eliminate ‘Dead Ends’ to Drive Engagement

What if I said there was something you were doing right now that was actively reducing your SaaS customer success? What if that thing you’re doing was standing in the way of driving higher levels of engagement and was reducing the amount of expansion revenue you’re generating while potentially increasing churn? What if I said […]

SaaS Customer Success: Start with Quick Wins

SaaS Customer Success starts by orchestrating “Quick Wins” for your customers, helping them bypass their natural tendency to seek out reasons not to use your service! I was in Silicon Valley recently and I found myself talking about this idea of “Quick Wins” several times within the context of SaaS Customer Success and I wanted […]

SaaS Churn Rate Improvement: Monitor and Drive Engagement

In my last post I shared some actual ways to reduce your SaaS Churn Rate, including attracting the right customer and managing expectations. In this post, I’m going to go deeper, and share some awesome methods for improving customer retention by leveraging the power of the SaaS business model, specifically the ability of the provider […]

SaaS Customer Onboarding: 3 Steps to a Successful Welcome Email

For many SaaS and Cloud providers, email will be the main fuel for your Engagement Engine that you use to drive potential customers through your Free Trial to conversion or to drive new customers to become deeply invested in your service. SaaS customer onboarding starts with the welcome email, so when I saw this great post […]

SaaS Market Positioning: How to Compete in Crowded Markets

Welcome to 2013 2014 2015 (still applies!)… it’s now time to figure out why your SaaS company even exists and what your market positioning is! If you’re a SaaS or Cloud provider in the Email Marketing, CRM, Project Management, File Sharing, Collaboration, Marketing Automation, Analytics,… or frankly most horizontal product categories… it’s time to do […]

SaaS Marketing Plan: 5 Ways to Get your App to Sell Itself

When creating your SaaS marketing plan, you must understand that your business model of choice is a fully-integrated architecture where all aspects of the business – product, support, revenue model, and marketing – are tightly-coupled. Deviation from that model and understanding will affect growth, and most deviation occurs as a rift between marketing and product. “The […]

Common Conversion Activities (CCA): SaaS Free Trial Metric

Before you read this article – which is really for companies that already have a good amount of customer data – I suggest reading a much more recent article “The Secret to Successful Customer Onboarding” which gives a much better perspective on how to design an onboarding (including Free Trial) flow. Once you’ve read that, come […]

5 Rules for SaaS Email Marketing and Transactional Messages

SaaS providers should use email to drive Engagement, Conversion, and Retention, but to achieve those goals, some rules should be followed. UPDATED FOR 2015! Regardless of the type of email – Transactional or Marketing – your email has to: Get Delivered Get to the Inbox Get Opened Get Read Get ‘Em to Take Action Bonus: […]

Growth Hacking: 43 Ways to Drive Traffic to your Website

WARNING: In 2014 2015 2016, relying heavily on SEO to drive traffic to your website is a recipe for failure! Okay, that might be a bit harsh… maybe SEO isn’t dead, but things have changed and you need to look beyond SEO to drive traffic to your website. If you put all your eggs in […]

Beta Testing & Pricing: Examples (Video)

Before you watch this video, you should watch the 25-minute Beta Testing & Pricing: A Hazardous Combination video for better context. In 2011 I pulled together this ~35 minute presentation for a group of SaaS entrepreneurs – literally overnight – where I explore the marketing sites of around 25 SaaS & Web App startups in Beta.

Beta Testing & Pricing: A Hazardous Combination (Video)

Learn to avoid the pitfalls of publishing your Pricing while in Beta in this video presentation Are you in Beta and getting ready to move to production? Did you already publish your prices on your website? Or are you thinking about running an extended Beta testing period for your new app? Well, you only get […]

How to Develop your SaaS Pricing Model

Developing your SaaS Pricing Model isn’t Rocket Science, but even in the Rocket Science business, you need to price your work so you can sell it and make money! This post is awesome (IMHO), but there’s an even better, more recent one that’s specific to early-stage SaaS companies: Pricing Strategy Framework for SaaS Startups Just so […]

Pivot to Profit: Ditch Freemium and Start Making Money

Let me be clear… I don’t hate Freemium. In fact, I don’t hate any marketing strategy, revenue model, or user acquisition method – including Freemium – I just think sometimes more thought needs to go into the selection – or subsequent ditching – of your business model. UPDATED FOR 2014! What I’ve seen in just […]

SaaS Pricing Model: How a 10x Price Increase lead to Happier Customers

Stormpulse adjusted their SaaS pricing model by raising their prices 10x… and getting happier customers in the process. So I just had a Progress Check and Planning meeting with a retainer client, Matt from Stormpulse, who told me since they moved away from Freemium just 4 months ago to a Premium-only SaaS offering with a […]

7 Tips for Software Vendors Moving to the Cloud

As a Strategic Consultant, I have worked with the Executive Teams of many Enterprise Software and Independent Software Vendors (ISV) to develop strategies for becoming Software-as-a-Service (SaaS) and Cloud Services vendors. …and I must say that I’ve come to what I consider to be a shocking conclusion: Far too many people think the Cloud is […]

How to keep App-generated Email from Being Marked Spam

The most concise definition of Transactional Email I could find (after a 7 second Google search) is: Email primarily containing information about current or prior business dealings, such as confirmation of a sale, a registration number, an invoice, or an opt-in or opt-out confirmation. Contrast this with “marketing email.” UPDATED FOR 2014! Transactional emails are those […]

SaaS Free Trials: The Shorter the Better?

Most people don’t realize that the length of a SaaS Free Trial is just a marketing gimmick designed to get prospects into the trial. Sure, 30-day Free Trials are the de facto standard for SaaS apps, but whether it’s 7, 14, 15, or 30-days, few providers can say WHY they came up with that length. […]

What’s the biggest issue you’re dealing with right now?

I do what I do for one reason… to help SaaS & Web App vendors be more successful. Period. If I’m not doing that, I’m not doing my job. Some I will help be more successful by working with them 1-on-1 or through programs like the Free Trial Dominator (which is awesome, IMHO). But others […]

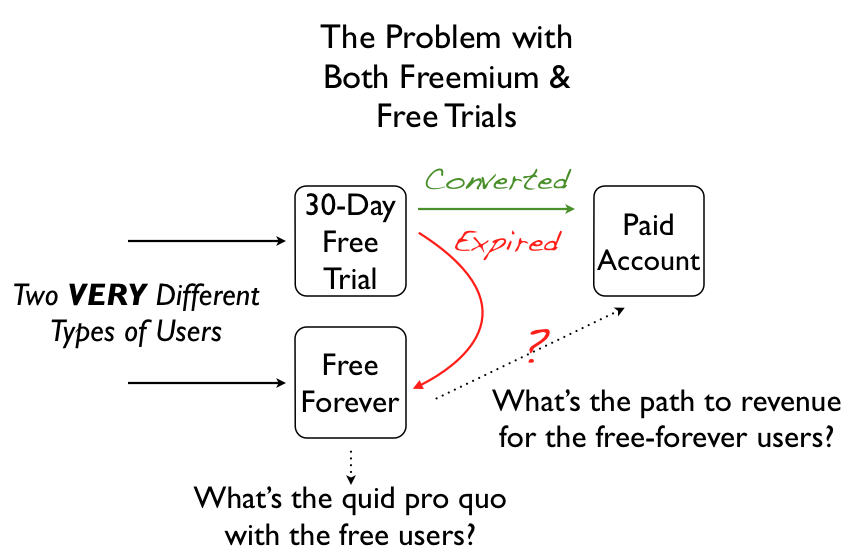

How to Offer Both Freemium and Free Trials

I got this question from a SaaS vendor about offering both Freemium and Free Trial options and I wanted to share my response to him with you. UPDATED FOR 2015! Our current app has two pricing tiers – free and paid. Simple pricing has its advantages! We’re coming out with a major redesign of the […]

What’s Your Biggest Challenge in 2012?

I believe in moving forward, not looking back. So my question as we go into 2012 is this: What’s Your Biggest Challenge as a SaaS or Web App Vendor in 2012? Is it making your Free Trials more effective at creating customers? Coming up with the right Pricing? How to handle Competition? Whether to go […]

Classical Freemium Doesn’t Exist At Scale

“Classical Freemium” is the marketing tactic where a SaaS or Web App vendor offers a Free-in-Perpetuity version of a product or service, often feature- or usage-limited, as well as a version of the same product or service with less limitations to which the vendor will attempt to up-sell the user. NOTE: I originally published this […]

SaaS Freemium Model Resource Guide

I put together this list of my BEST SaaS Freemium posts just for you. I hope it helps! Freemium or Free Trial? Ask a Better Question State of B2B Freemium 2013 (Slides from my presentation) Pivot to Profit: Ditch Freemium and Start Making Money SaaS Freemium Customer Acquisition Costs There are 7 Types of Freemium and […]

The 7 Secrets to DOMINATING Your Free Trials

In addition to the years I’ve been working with SaaS & Web App vendors, I’ve spent 2011 totally immersed in the business of free and have helped dozens of companies – from super early startups to MASSIVE $B/year companies – completely DOMINATE their free trials. Nothing else I’ve done has produced such AWESOME results – […]

Wait… You Actually WANT to Be Average?

What’s the average conversion rate for free trials, pricing pages, or Freemium with SaaS or Web Apps? There are some fundamental problems with “average conversion rate” which is why people rarely like my standard answer of: “It depends” or my more direct answer of “why, so you can be average?” Look, if you have a […]

There are 7 Types of Freemium and Why That Matters…

You think you know Freemium in SaaS? Think again! In 2009 I released the version of “The Reality of Freemium in SaaS” PDF and since then the “Freemium” landscape in SaaS has continued to evolve rapidly. Freemium use in B2B technology / software / SaaS / Web Apps / Cloud (whatever) is evolving and I […]

Why OfficeDrop Went Freemium… and how Mobile Apps forced their hand

Was OfficeDrop forced into Freemium at phone-point? Healy Jones, VP Marketing at OfficeDrop, told me exactly how leveraging mobile apps made Freemium the right strategy for them. Do you prefer to listen on the go? Download the .mp3 audio file (33.7MB) here. Wistia has kindly donated business video hosting to me, which pretty much makes […]

Assistly Marketing VP Tells You Why They Dropped Tiered Pricing and Picked Up Freemium

UPDATE: Assistly was acquired by Salesforce.com shortly after we did this interview… they are now Desk.com. I sat down and chatted with Assistly’s SVP of Marketing Matt Trifiro via Video Skype and he spilled his guts for you about why Assistly changed their pricing, adopted Freemium, and set out to disrupt the market… all at […]

SaaS Business Model Resource Guide

I put together this list of my BEST SaaS Business Model & Architecture resources just for you. I hope it helps! Software Vendors: The Cloud is Not Magic (but it can be very Profitable!) SaaS Business Architecture Overview (PDF) The 7 SaaS Revenue Streams Report (PDF) Think You’re Ready for SaaS? Think Again! (PDF) SaaS Companies […]

SaaS Distribution and Promotion Resource Guide

I put together this list of my BEST SaaS Distribution & Promotion posts just for you. I hope it helps! How to Get in Front of your Ideal Customers Traffic Hacking: 43 ways to get quality prospects to your site 100 Places to Promote Your SaaS or Web App (Part 1) 100 Places to Promote Your […]