Here’s a secret no one talks about: SaaS Free Trial Length is a Marketing Gimmick.

Here’s a secret no one talks about: SaaS Free Trial Length is a Marketing Gimmick.

There isn’t a best SaaS Free Trial length that works for every SaaS company, in every category, for every market.

I know, that contradicts my reputation for saying “always do this” or “always do that” but that’s the way it is; the only best Free Trial length is whats best for your current situation.

For instance, I recently helped a company that has a 7-day free trial.

In the context of their current situation – offering / market / customer / value prop / speed of value recognition by customers / etc. – a 7-day free trial seemed to make the most sense. Sure, they had 99 problems, but Free Trial length wasn’t one of them.

But there is something I want you to always do … and that’s to think before putting up a Credit Card wall, developing your Pricing Strategy, or coming up with a Free Trial strategy – including choosing the length of the trial.

This article will help you avoid picking a Free Trial length at random, will help you understand why doing that is a bad idea, including why you should understand your customers, the market, expectations, how your value prop and competition will influence your prospects view of the trial length you selected for your product, and much more.

Here we go…

Short Free Trials Keep Potential Customers Out

If the trial is too short, you run the risk of keeping potential customers from signing-up in the first place, which is the exact opposite of what we’re going for here.

I say it all the time, but you should be looking for ways to get MORE people to sign-up for your SaaS app… not ways to keep them out.

As I’ve said before, Free Trial length is an external-facing marketing gimmick and if the Free Trial length is considered too short to be realistically effective, it’s a non-starter.

And when thinking about the length of a Free Trial, remember that “too short” is relative… it’s all about the customer.

Remember, people are busy and distracted… if they don’t think you’re going to give them enough time to evaluate the product, they’ll pass. They might tell themselves – and maybe even you – that they’ll come back later when they have more time or the time is right… but they won’t. You lost ’em before you ever had ’em.

Decouple Trial Length and Time to Conversion

And this is why Free Trial length absolutely MUST be decoupled from the behind-the-scenes sales process, including conversion timing.

Which means, if you’re trying to figure out your sales cycle length based on your current Free Trial length… you’re doing it wrong.

Believe me… this way of thinking about SaaS Free Trials flies in the face of conventional wisdom… it goes against just about everyone anywhere that ever talks about Free Trials.

And as far as I know, no one thinks about Free Trials like this but me… and my clients and friends who’ve found success with this thinking.

Free Trials and Perceived Bandwidth

The length of Free Trial you promote to your prospective customers has to be long-enough for them to feel like they’re going to be able to adequately evaluate your offering.

Too often, short trials keep people out because they don’t feel like they’ll be able to adequately “test” or “try” or “kick the tires” or “evaluate” or …, your product.

Okay, but how do you know that your Free Trial length is keeping – or will likely keep – prospects from even signing-up?

- Talk to customers to understand their product evaluation process

- Talk to prospects to understand their product evaluation process

- Talk to the customers of your competitors and see if they didn’t try your product due to trial length

- Talk to the customers of adjacent products – shared customers, same price, same buying cycle/process, etc. – to understand expectations around trials

- A/B test a 14-day Trial and 30-Day trial CTA (even if the rest of the trial is still the control length)

- Analyze, Monitor, and Optimize your “website visits to sign-up” metric

- Use your imagination… come up with other ways to figure this out

Myth: Short Trials Keep out The Riff Raff

I don’t know about you, but I want as many people to sign-up so I can convert more customers, even if that drops the conversion “rate” but drives the number of actual new customers up.

Sometimes conversion “rate” can be a vanity metric.

But I know the pushback on this… “if we offer a longer trial, we’ll get people in who aren’t serious and they won’t convert.”

In my experience, if we’re getting a lot of people in the trial that aren’t converting or engaging with the product, it isn’t the lack of time pressure from a short trial that’s the problem!

Rather, it’s other things like who we’re targeting, our messaging, value prop, the partners we have, etc.

The reality is, people (marketers, startup founders, executives, investors… humans!) tend to blame things we don’t understand, rather that tackle the things we know (if we’re honest) aren’t really working.

You may have the most engaging, ah-ha-moment inducing on-boarding process – especially if you’re disrupting a staid, Enterprise-focused product category – but if people won’t even sign-up to try it because they don’t think 3 days or 7 days or whatever is long enough to properly evaluate the product (possibly because “how can it be… this is [a BIG Enterprise category with a reputation for complex installations] “), then they won’t even sign-up to try it and you’re missing out.

Of course, once they’re in the trial, you have to work diligently to convert ’em to paying customers in a short of time as possible.

The bottom line is that fee trial length is an external-facing marketing gimmick Offer a 30 day free trial? Great.. work diligently to convert ’em on day 3 if you can. (hint: by asking for the sale after they’ve achieved the Common Conversion Activities – CCA).

Take Constant Contact for example. Their suite of products based around their core email marketing platform is targeted primarily at the Small / Medium Sized Business (SMB/SME) market. They realize that these people are super-busy and offer them a full 60-days to try Constant Contact.

But reading this post by Constant Contact CEO Gail Goodman about getting people to that “Wow!” moment quickly, it’s clear they’ve decoupled the external-facing Free Trial length of 60-days from their internally-facing sales process timing.

SaaS Free Trial Length tied to Perceived Complexity

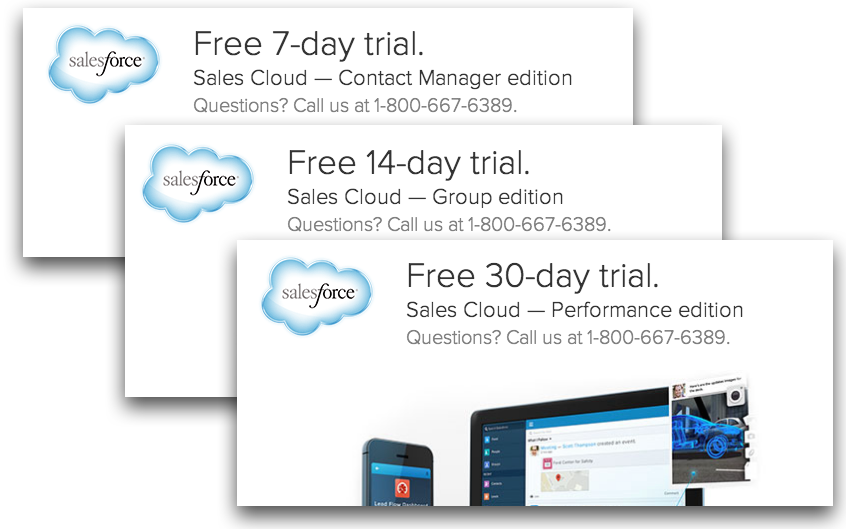

You can even do what Salesforce.com does, and that’s to use Free Trial length to differentiate their $5/mo, $25/mo, and $300/mo editions at 7, 14, and 30-days respectively.

The more complex the product edition, the longer you’ll need to evaluate it, right? Makes sense.

So, How Long Should your Free Trial be?

Customer-Facing: Long-enough to make your prospect feel like they can effectively evaluate your product.

Internally: As short as possible.

To figure out how long your trial should be, you need to understand your customer, know what the expectations are in the market, how your customers think, what your product is displacing in their world, etc. and you’ll know how long the trial length should be.

Once they’re in, your job is to convert them into a paying customer ASAP regardless of the trial length.

If you have a 30-day Free Trial, it doesn’t mean they don’t become a paying customer until the trial expires or on Day 31 (though this is unfortunately typical).

They come in thinking they have 30-days to evaluate the product, but you see it as you have 3 days to get them to USE the product and to convert them to a paying customer within the first 7 days.

You do this by streamlining the on-boarding process, getting them to the Wow! moment quickly, getting them to realize value ASAP, and then asking for the sale by making offers congruent with their use thus far.

This is how I helped one SaaS company take their average conversion time on a 30-day Free Trial from 42 days (yes, an average of 12 days post-expiration) to 3 days. Oh, and through the use of creative discounts I helped them drive their Average Subscription Value (ASV) up by 33%.

I hope this helps a bit.