I’ve been saying for years that Customer Success is transformative; driving exponential value for both the vendor, as well as the customer. In fact, it’s that value growth for the customer that truly drives the value growth for the vendor. What goes around, comes around.

And while the following is something I’ve shared with clients, workshop attendees, portfolio companies of Venture Capital and Private Equity funds Storm Ventures and Accel-KKR in the United States, NDRC in Ireland, e.Bricks Ventures and Redpoint eventures in Brazil, as well as covering this in my keynotes around the world…

… I’ve never really put this out there for public consumption.

Until now.

But first, what do I mean when I say “drives value” for the vendor? How does Customer Success truly affect the company that adopts it as it’s purpose such that it impacts everything they do?

Customer Success drives up the value of your company. How’s that for impact?

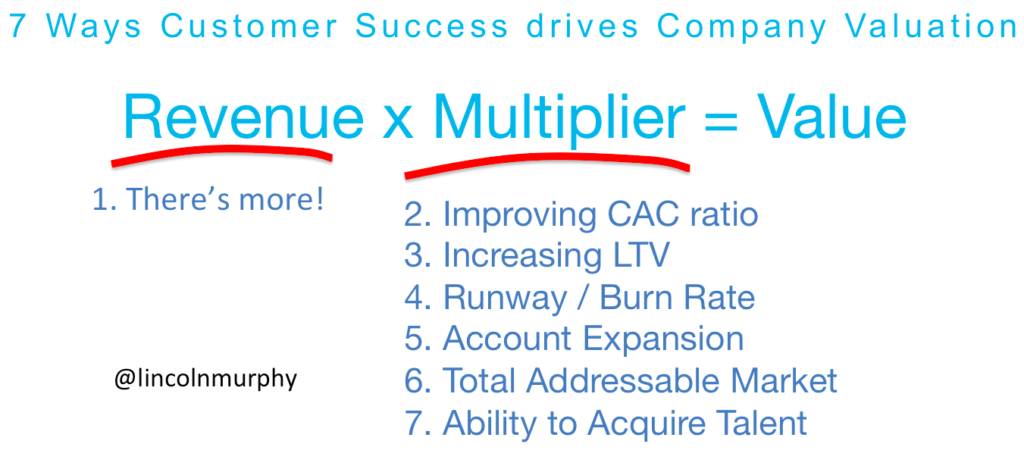

In fact, let’s look at 7 ways Customer Success drives the Value of your Company.

In the good times, when investment dollars are flowing like wine and acquirers are flocking to startups like the salmon of Capistrano, Customer Success will help ensure the irrational valuation for your company is exponentially higher than the irrational valuation of a similar company.

In the bad times, when $1 of recurring revenue is worth less today than it was 6 months ago, investment is drying up, and deal-seeking acquirers are circling like vultures, you’ll make sure that your company is valued at the top of whatever the cynical market is willing to pay.

Valuation: Simplified

There are many ways to determine the value of a company. I’m going to use a very simplified version of how startups are valued here, but everything I’m going to cover can be extrapolated out to fit any scenario.

For SaaS startups, the value of your company (to investors or acquirers) is determined by this simple math problem:

Recurring Revenue x Multiplier = Company Value

Customer Success impacts BOTH sides of that multiplication problem.

Recurring Revenue

First, Customer Success drives the value of your company in a very simple way; you’ll have more revenue.

1. More Revenue

I’m going to keep this super simple, so we’ll say that “revenue” is simply Monthly Recurring Revenue (MRR). But it could be ARR (Annual Recurring Revenue/Run Rate), Bookings, Sales Velocity, or whatever fits your situation.

- When customers stay longer and don’t churn out, you’ll end the quarter with more customers and, therefore, more revenue than if you had a high churn rate.

- When customers don’t downgrade or if you don’t have to offer discounts to keep ’em around, you’ll end the quarter with more revenue.

- When customers pay more (they buy more seats, add-ons, or move to a higher pricing tier, or they invite your product into other parts of their company, etc.) you’ll end the quarter with more revenue. Ensure this happens by operationalizing around a predictable Ascension Model.

- When customers buy more non-recurring services – like training and consulting – they will buy more of your recurring revenue product (if you operationalize this correctly) and you’ll end the quarter with more recurring revenue.

- When customers advocate for you and your sales velocity accelerates, you’ll end the quarter with more revenue.

- When you understand the customer’s Desired Outcome and continually feedback learnings from your Customer Success Management organization to Sales, Marketing, and Product to better align and resonate with the customers, the sales cycle will shorten and velocity will improve, leading to more revenue at the end of the quarter.

Yeah, so even if you don’t know or care about this “multiples” concept (or you’re bootstrapped, will never raise money, and never plan to sell), at least realize Customer Success drives revenue growth. That’s never a bad thing!

But it gets even better…

Multiplier Inputs

If you’re interested in how company valuations are derived, and how Customer Success can be a catalyst to a higher valuation, then you’ll want to understand how investors and acquirers come up with this “multiplier.”

Unfortunately… they won’t tell you what goes into the multiplier. But I will.

And I’ll even tell you how Customer Success impacts each input.

Just know that the better you’re doing in each one of these categories, the higher the multiplier. If you’re failing at one (or all) of these, the investor or acquirer will reduce (discount) the multiplier accordingly.

While I can’t be certain this constitutes the entire proprietary multiplier recipe your investor(s) or potential acquirer is using to determine their idea of the value of your company, these are a few of the common inputs you should be aware of:

2. CAC Ratio

Customer Acquisition Cost (CAC) is a key SaaS metric that indicates the fully-loaded cost to acquire one customer. The misconception is that this cost should be as low as possible. That’s not true, and in many cases, you want to be able to spend more on acquiring customers than your competition.

The more important metric is the CAC Ratio, that is how the CAC stacks up against the lifetime value of the customer. The quicker you can get to a profitable customer (unit economic-wise), the better, since this means we have more time with a profitable customer and less risk of losing that CAC should they churn out before they hit their Stick Point.

CAC costs will also be reduced by an increase in customers advocating on your behalf. From online reviews to case studies, and from viral expansion to reference calls, customer-driven growth is an accelerator of CAC Ratio efficiency and shouldn’t be left to chance (it should be orchestrated just like account expansion… see below).

Investors and Acquirers want to see this ratio improving, with the CAC being recouped quickly and ultimately eating up a relatively small part of the overall Customer Lifetime Value.

Customer Success leads to an improved CAC Ratio in several ways: from Sales & Marketing better aligning and resonating with prospects and thereby reducing sales cycles and increasing effectiveness of other marketing spend, to acquiring only good-fit customers with Success Potential which drives down avoidable churn and virtually eliminates unavoidable churn.

Of course, the best way to improve CAC ratio is to improve the…

3. Customer Lifetime Value (LTV)

Have you ever wondered – privately, no one would ever admit not knowing this publicly – how Customer Lifetime Value (LTV, CLTV, CLV, CCTV?) fits into this whole thing?

It always struck me as odd that LTV is talked about as important – and it seems obvious that it would be – but when you talk about valuation, you only ever hear about multiples of current revenue.

And it seemed to me that even though LTV was “important” it was really current revenue that mattered most. That’s why salespeople are incentivized (and full-on instructed) to close whatever deals they can today, long term success of the customer be damned. It’s all about today’s revenue.

But then I learned that while revenue today is great – it’s what is being multiplied to come up with the value of your company – it’s the other side, the multiplier, that also matters a whole lot. And it’s within the multiplier where LTV becomes important.

Straight-up, investors and acquirers want to see LTV increasing; when they buy revenue today, they want it to be worth a lot more in the future. Read that again.

Increasing LTV, through extended lifetimes (simple customer retention), and expanded revenue (Upsells, Cross-sells, etc.) is a very good thing from their point of view.

And Customer Success is the way to keep customers longer, which increases their LTV even if they never increase the amount they pay, but is also the key to moving customers along an Ascension Path, substantially driving LTV along the way.

4. Runway / Burn Rate

Investors – outside of the irrational times – don’t like to see out of control burn rates, or the using up of invested funds to simply exist. They want to know that when they invest in a company that the capital will go to things that increase the value of the company.

What a company spends to exist is the gross burn; when you reduce that by the revenue generated, you get the net burn. So the more revenue you have, the less net burn you have (in theory and assuming your expenses don’t increase to match the new revenue).

And while Customer Success won’t do much to reduce the cost of an office in San Francisco or daily catered brunch and beer pong tables, it will impact net burn rate in several ways (beyond those I’ve mentioned elsewhere in this article).

Here are two of the many, many ways Customer Success can help increase your runway:

Leveraging AX-Based Coverage Segments for Optimal Capacity Planning

When you’re aiming for optimal capital efficiency—stretching your runway and reducing burn rate—your Customer Success headcount becomes a key variable. Traditional models of Customer Success focus on revenue-based segmentation, resulting in inefficient allocation of your most valuable resources—your Customer Success Managers (CSMs). The old-school approach can lead to both underutilized and overburdened CSMs, ultimately draining your runway faster and affecting your burn rate negatively.

Enter AX-Based Coverage Segments. By focusing on the customer’s Appropriate Experience (AX), and grouping customers by shared AX, you align your resources in the most efficient way possible to deliver those experiences. What does this mean in terms of capacity planning? It means your CSMs are focused on delivering the specific outcomes that customers in their segments truly value, enabling more precise resource allocation.

The right CSM is matched with the right customer segment, optimizing workloads and improving both customer and employee satisfaction. This streamlined approach minimizes overhead and operational inefficiencies, allowing you to get the most value from your headcount. In doing so, you can significantly extend your runway, reducing burn rate while ensuring your customers still achieve their Desired Outcomes.

By adopting this nuanced approach to Customer Success, you’re not just ticking off boxes—you’re building a sustainable, scalable model that respects both the customer’s journey and your company’s financial health.

Get Paid First

When the economy takes a negative turn – or when something happens in the industry you serve – customers may have to make decisions on what vendors to pay this month.

If you are focused on Customer Success and are therefore ensuring your customers achieve their Desired Outcome, when your customer has to make the tough decision of who to pay this month, you’ll be at the top of the list.

Of course, this logic applies to the good times as well. The best way to ensure that you get paid quickly, that renewals happen in a timely manner, and that you don’t have to offer discounts or other concessions to make that renewal happen – or to keep the customer – is to ensure they know they are getting value from their relationship with you.

5. Account Expansion

However you look at this phenomenon – Gross Revenue Retention (upsells), Net Revenue Retention (upsells – revenue churn), Expansion, Ascension (whatever it is, please never say “negative churn” again… ugh) – this is one of the key drivers of company valuation.

This is why I say Account Expansion – aside from the fact that it helps your customers evolve and get more value from their relationship with you – is too important to leave to chance; operationalize logical account expansion and create a truly predictable revenue model.

If you think about it that way, when you can grow revenue from your existing customer base, you could turn off new customer acquisition and not just stay in business, but actually continue to thrive and grow.

Think about how that looks from an investor standpoint? They aren’t putting money into something that they first have to stop from shrinking; they’re putting money into something that could sit there and grow. Yaaaas!

Now consider that scenario, but with Desired Outcome-fueled customer acquisition turned back on. Yowza!

6. Total Addressable Market (TAM)

Investors and acquirers want to know that there is a massive opportunity out there that you (or they) can take advantage of.

If you’re churning and burning through customers, however, you are shrinking that TAM.

If you say you have a TAM of 100k customers in your pitch deck for investors, but you’re churning through 10k customers per year, your TAM, after one year, is now 90k.

Those customers who aren’t your customers anymore are very likely never going to be your customer again. They’re gone. You can remove them from your TAM calculation.

Of course, if you’re churning through 10k customers per year, the likelihood that you only reduced your TAM by 10k is low; that’s a lot of customers to burn through and it probably came with some bad feelings. Some ill will.

And that negative sentiment didn’t stay with the customers that left, oh no; they shared their feelings on review sites, forums, blog posts, social media, bathroom stall doors,… anywhere and everywhere they could.

So your TAM – because you’ve been churning and burning customers – is now maybe reduced by 50%. That’s bad.

On the flip side, if you focus on Customer Success, create an environment purpose built for your customers to thrive, and you’ve operationalized getting your customers to achieve their Desired Outcome, your TAM won’t just shrink… it’ll grow.

Since you won’t have churn, you’re not burning customers who’ll go out and spread the negative word.

And since you’re helping them achieve their Desired Outcome, they’ll be likely to advocate for you.

And since you’ve operationalized that advocacy (and aren’t leaving it to chance), you can ensure it’s happening at scale on a predictably consistent basis.

And since you’re constantly improving your understanding of the customer’s Desired Outcome and the successful use cases, you’re constantly expanding your reaching into – and quickly resonating with – new market segments, further growing your TAM.

7. Ability to Acquire Talent

Something few people really think about is how the ability to acquire talent impacts the value of a company.

Something even fewer people think about is how Customer Success impacts the ability of a company to acquire talent.

Did you know a good source of competitive intel is Glassdoor? Go look at the Glassdoor profile for your competitors (and your company) and you might find some interesting things.

If a company is churning and burning customers, it is very likely they’re churning and burning employees, too.

Aside from the fact that the culture in a company that doesn’t care about its customers is not one conducive to employee longevity (and vice versa), it just plain sucks to work for a company that can’t keep it’s customers.

Maybe they don’t care about the customers, maybe they sell to customers they shouldn’t, maybe they don’t have the product they tell their customers they have (or maybe all of the above), but whatever it is, working in that environment is not a fun way to go through life. So people quit.

But in 2016, you don’t have to go quietly (I mean, you’ll still be escorted by security, but after that, all bets are off). You head over to Glassdoor and you spill your guts. No trade secrets (maybe), but you lay out the horrible environment, the abusive CEO, the “vaporware” your aggressive sales people are talking people into buying, etc.

And Glassdoor ranks really, really high in Google search results.

How likely are you to acquire top talent for your company with Glassdoor reviews like that? How likely are you to acquire ANY talent?

So when an investor puts money into your company and says “step on the gas” by ramping up hiring and you can’t because you churned and burned customers and employees… that’s a problem.

A company with Customer Success as it’s purpose and it’s Operating Model will by its very nature avoid many of these problems. Investors and acquirers will like that.

CEOs and Executives Must Care About Customer Success

Now maybe you can see why if you’re a CEO, CRO, or CFO, this is why I’m always warning you not to see Customer Success as a low-level departmental function, but as a strategically important initiative for the value of the company and the value to your shareholders.

And if you’re a Customer Success Practitioner, VP Customer Success, or obviously a Chief Customer Officer (CCO), this is why I tell you to stop talking about “customer happiness” or “delight” and start focusing on the real value you bring not just to your customers (actual success), but to the company stakeholders (increased valuation).