I believe in moving forward, not looking back. So my question as we go into 2012 is this: What’s Your Biggest Challenge as a SaaS or Web App Vendor in 2012? Is it making your Free Trials more effective at creating customers? Coming up with the right Pricing? How to handle Competition? Whether to go […]

Archives for December 2011

Average Free Trial Conversion Rates… and why they don’t matter

I get asked what the average Free Trial conversion rate is or “what’s a good conversion rate” all the time. But since I’m not an analyst or researcher I don’t have industry-wide data, but even if I did, well… you’ll see. Softletter (the SaaS University folks) on the other hand collects and publishes this type […]

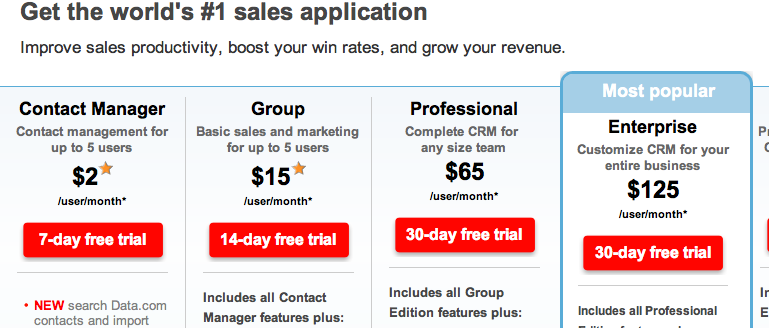

What’s the Ideal SaaS Free Trial Length?

So, what’s the ideal Free Trial period is for SaaS and Web Apps? As you can imagine, I get asked that a lot. Sure, the 30-day Free Trial is common among B2B SaaS & Web App vendors, but there aren’t any rules. And with everything from 14-day to 60-day (and longer) trials appearing frequently I […]

Year-End Free Trial Conversion Ideas

Today is December 26, 2011. You have 6 days – including today – until the year 2011 is over and done with. So what are you doing to convert those currently in your Free Trial to customers in 2011? It isn’t too late to convert them! I’m willing to bet that you have some users […]

Classical Freemium Doesn’t Exist At Scale

“Classical Freemium” is the marketing tactic where a SaaS or Web App vendor offers a Free-in-Perpetuity version of a product or service, often feature- or usage-limited, as well as a version of the same product or service with less limitations to which the vendor will attempt to up-sell the user. NOTE: I originally published this […]

SaaS Free Trials: Common Problems with Sign-up Forms

I just posted the video from the 12/21 Group Coaching call to the Free Trial Dominator site. I started by showing an email sent by 37Signals to former prospects as a way to get them to come back. It used the “updated feature” method. I reviewed the marketing sites – from the marketing site, to […]

Focus on People, not Features, in 2012 (Happy Holidays!)

For a lot of us, the holidays are a time of reflection. Looking back on 2011, I’d say this has been one wild and crazy year! I’ve spent a ton of time working with the best SaaS & Web App companies on the planet to get them more customers. Save for the occasional social network […]

The Free Trial Secrets of 100’s of SaaS vendors… just for you

Peter Drucker famously said “The purpose of a business is to create a customer.” I say “The purpose of a Free Trial is to create a customer.” If you believe my version, then the Free Trial Dominator is for you. I’m capping Charter Memberships at the first 10 members and I’ll close it down as […]

SaaS & Web Apps: Optimize Your Pricing Page for 2012

Your Pricing Page is the most important marketing page on your site. Don’t believe me? Think about this… if 100% of your sales come from the Pricing Page, then you better believe that it’s the most important page on your site! And it better be designed to convert! There are some very specific things that […]