Starting a SaaS company and scaling a SaaS company are two very different things.

Starting a SaaS company and scaling a SaaS company are two very different things.

The same is true for “scaling” a SaaS company in the very early days vs. scaling a SaaS company through the growth phase.

And since every company is different and experiences those “phases” at different times in different ways, you have to be careful with blanket statements about what works and what doesn’t.

Everything is situational, which is why when you read a post where the author says Customer Acquisition Costs (CAC) doesn’t matter, you need to understand the big picture.

Perhaps what you missed was when he said they don’t matter in the early days.

Or maybe you missed the part about how that post was talking specifically about heavily-funded startups with 6-figure Annual Contract Values (ACV) and an Enterprise sales model.

The reality is, every person that writes about SaaS metrics is doing so with certain situations in mind and if you aren’t in the situation the author is talking about, then you may wish to consume that writing with a pinch of reality salt.

Not because what the author said isn’t true, but because it might not be true for your current situation… for your current reality.

Which is why when my friend Aaron Bird, CEO and Founder of Bizible (they’ve raised $10.5M since mid-2011), was talking about how a SaaS company’s Customer Acquisition Costs (CAC) Strategy (and Efficiency) is key to scaling I asked him if he’d share that with the world… and he did.

I have a couple of things to add in the Afterword below, but for now I’ll turn it over to Aaron…

Scaling A SaaS Company? Why Your CAC Strategy Is The Most Important Factor

Scaling a SaaS company looks very different compared to businesses with non-recurring revenue streams. And this often confuses investors attempting to measure the health of a growing SaaS company.

In microeconomics 101 you are taught companies that can reduce cost of goods will have a competitive advantage. With reduced cost of goods it costs less to produce each unit, giving that company the ability to beat competitors on price.

As the theory goes, in the long run the price will equal the marginal cost of production (i.e. the incremental cost of producing one more unit). And you could use these cost indicators to measure whether you had a winner or loser.

But this theory doesn’t work in SaaS.

In SaaS the marginal cost of production is just about zero. The additional server costs to serve one additional customer is very close to zero. There are no inputs like factories or production workers. This suggests the price of SaaS will approach zero, but we know this isn’t true. If anything the price of SaaS is going up.

So how do you compete on unit economics and why doesn’t econ 101 work in SaaS?

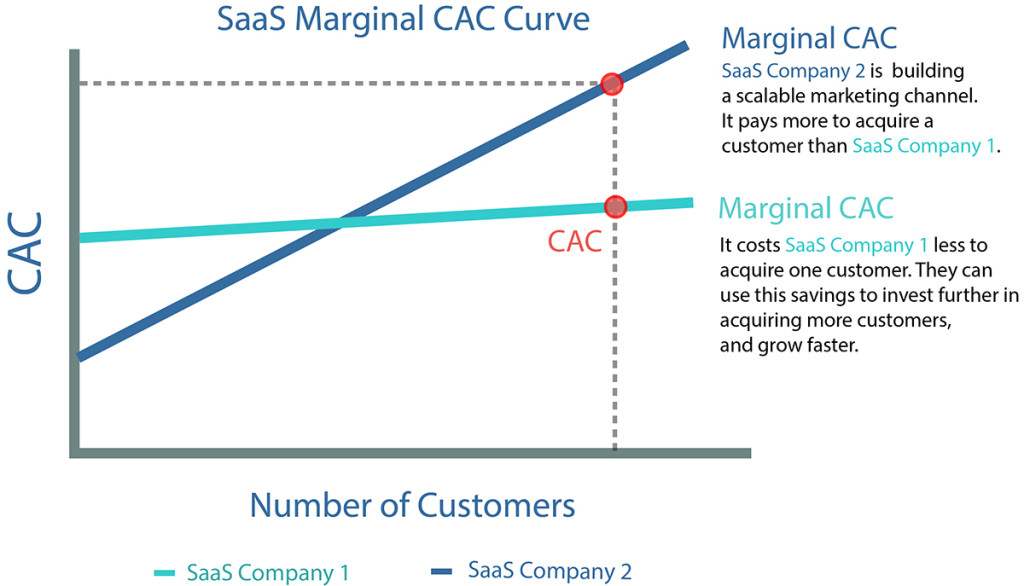

In SaaS the cost of sales and marketing is the real marginal cost. Scaling SaaS is finding a scalable way to lower your customer acquisition costs.

For founders, two things are true, you have to grow fast and you’re going to have to fundraise to fuel it. To do both, you need a strategy for lowering your customer acquisition costs. It’s the competitive advantage for SaaS companies. It’s the predictor for growth — i.e. getting from initial traction to initial scale.

When you achieve lower CAC, it cuts down the acquisition cost payback period, allowing you to invest immediately into acquiring more customers — i.e. grow faster.

Hubspot became the second fastest SMB SaaS company to IPO due to its CAC efficiency. Hubspot’s efficiency in acquiring customers comes from its mastery of demand generation, having built a content hub that generates sales (its blog).

Hubspot’s inbound hub is an asset they no longer have to pay for, they don’t need to pay for web traffic or media. Hubspot built and paid off its factory. And they use that competitive advantage to beat it’s competitors on lead generation.

Apptio created the Technology Business Management conference. It attracts c-level IT leaders from Fortune 100 companies to meet about the future of IT. The conference draws in thousands of CIO’s and senior IT managers, i.e. their target buyers.

The event is a growth engine for Apptio, allowing it to generate leads at much cheaper cost compared to competitors without a brand recognizable event.

Hubspot and Apptio created a barrier to entry with their marketing assets.

Each additional visitor to HubSpot’s blog has very little incremental cost for HubSpot. And each CIO that attends Apptio’s annual conference requires less advertising spend. They don’t pay for sales leads.

The graph below illustrates the impact of a scalable marketing channel or asset. Once a CAC strategy becomes scalable, that company experiences a competitive cost advantage and pays progressively less than the competition to acquire a customer.

How do you know when you’re getting to initial scale?

Healthy SaaS companies spend less to acquire customers WHILE yielding a positive financial return over the lifetime of the customer.

If your numbers are healthy it means you have an effective way to scale your CAC strategy.

These numbers will help you from a fundraising standpoint, a lower CAC says you’ll be able to scale quickly. You’ve hired a team that generates demand and closes deals faster and cheaper. This efficient unit means each dollar that goes in results in a positive yield the following the year; and you can expect this yield to continue its upward trajectory.

Building a scalable marketing asset comes after you’ve hit initial traction. The tactics you used to get to initial traction won’t get you to scale. On the latter, you need to be building a marketing asset that reduces your CAC.

Microeconomic theory doesn’t fit the SaaS model, especially given the freemium strategy in SaaS marketing. Manufacturers win with superior products and cheaper production costs. SaaS companies win through efficient sales and marketing.

Manufacturers find a cheaper way to produce something, generating demand. SaaS companies design a product AND design a way to generate demand. A good product can help get you there, but a cost efficient sales and marketing team will get you there.

About Aaron Bird

Aaron Bird is the CEO and Co-Founder of Bizible, a that helps companies – particularly B2B SaaS – make profitable marketing decisions by attributing digital marketing to revenue in the CRM. You can follow him on Twitter at @birdstweets.

Afterword by Lincoln

Lincoln here again.

I just have to repeat what Aaron said: “SaaS companies win through efficient sales and marketing.”

It’s true, and whatever sales and marketing model is required to reach, connect with, and convert your Ideal Customers – high-touch or self-service, inbound marketing or outbound prospecting – the key to scaling is making that process as efficient as possible.

And that’s why when Jason Lemkin (the SaaStr, and who I was referring to in the intro above) said recently that Customer Acquisition Cost is Usually Irrelevant in the Early(ish) stage of a SaaS company it was a good reminder that you should totally listen to what he says because his words are very wise, but you should do so knowing that his words are also very, very situational.

Which is why it’s awesome to also hear from someone like Aaron, who is speaking about his situation… which reminds me… it’s his situation… yours may be different.

BTW, Key & Peele has ruined me… I can’t say Aaron’s name the right way anymore.